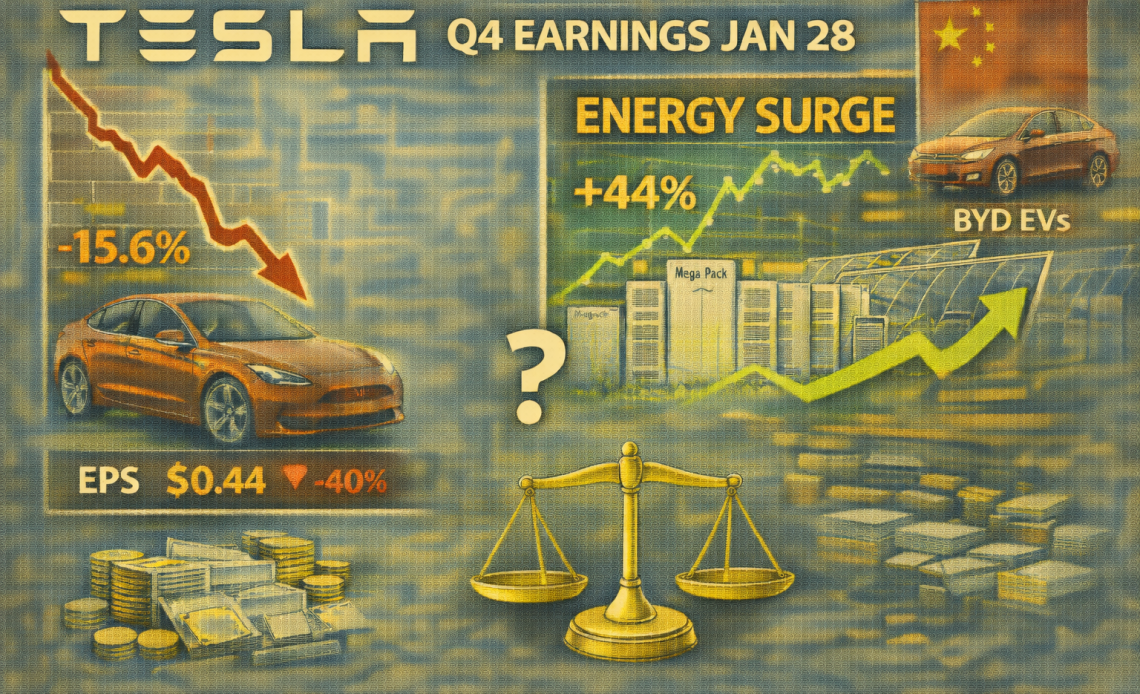

Tesla (NASDAQ: TSLA) reports Q4 2025 earnings on January 28, and Wall Street has already bracing for tough numbers.

The consensus estimates expect the revenue to fall 3.6% to $24.5 billion, while profit per share could tumble 40% to $0.44, reflecting a 15.6% drop in vehicle deliveries.

The numbers look brutal as Tesla’s auto business is slowing, margins are under pressure, and competition from BYD is intensifying.

But beneath the surface, Wall Street is maybe missing a crucial wild card, which may change the game for the automaker.

The energy profit engine may surprise

Tesla’s Energy segment is becoming the quarter’s protagonist.

The company deployed a record 14.2 gigawatt-hours of storage in Q4, and analysts expect energy revenue to hit $3.825 billion at a gross margin of roughly 31.1%.

That margin is nearly double the squeezed 17% automotive gross margin.

Here is the strategic shift as automotive margins compress (down from 21% two years ago), energy is emerging as the profit cushion.

Energy revenue grew 44% year-over-year in Q3 and is accelerating.

The driver is the central demand from AI data centers that need grid-stable power.

Tesla’s Megapack solves a critical bottleneck by smoothing volatile power supply for hyperscalers like xAI, Google, and OpenAI.

One analyst calls Tesla the “arms dealer in the AI infrastructure boom.”

Tesla Q4 earnings preview: Structural headwinds compressing profit quality

In Q3, regulatory credit revenue collapsed 43.6% year-over-year to $417 million.

Republican legislation stripped emission penalties, eliminating credit demand overnight.

Consensus forecasts a 75% revenue decline in 2026. Without this buffer, compressed automotive margins hit the bottom line harder. This is the “phantom profit loss” nobody is discussing.

The Musk partisan effect

A Yale study (October 2025) quantified what was intuitive: Musk’s political actions cost Tesla 1.0–1.26 million potential vehicle sales from October 2022 through April 2025.

In Q1 2025 alone, the effect was 150%, meaning sales collapsed despite zero change in product or EV market fundamentals.

Europe down 27.8% in 2025? Partially Musk-driven. The management commentary on Western European demand is going to be important, particularly in Germany, to signal if brand damage is stabilizing or accelerating.

The FSD subscription conversion question

Tesla shifts Full Self-Driving pricing from an $8,000 one-time purchase to a $99 monthly subscription effective February 14.

This creates a January buying surge. January comps will spike, but Q1 will face a cliff when the subscriber base matures and churn emerges.

Management will not disclose subscriber numbers, but any guidance on monetization risk matters here.

Without regulatory credits, facing brand headwinds, automotive margin compressed, and encountering China competition, Tesla’s auto profit generation is expected to be materially weaker than consensus models assume.

Energy growth and software monetization must be material offsets, not bonus rounding errors.

The post Tesla Q4 earnings preview: Wall Street expects weak numbers, but a key wildcard looms appeared first on Invezz