Stock futures edged higher as trading for 2025 began, with investors hoping to continue the robust gains seen over the past two years.

Dow Jones Industrial Average futures gained 198 points, or 0.46%, while S&P 500 futures rose 35 points, or 0.60%.

Nasdaq-100 futures led the advance, climbing 166.75 points, or 0.79%.

The indices would be looking to halt the four straight session losing streak on Thursday. The last few days of the year did not exactly convert into the much-awaited “Santa Claus rally”.

Although markets saw a pullback in the final days of December, 2024 was a year of strong performance.

The S&P 500 closed the year up 23%, while the Dow rose nearly 13%.

The Nasdaq Composite stood out with a 29% gain, fueled by excitement around artificial intelligence and easing interest rates.

Key stocks in the “Magnificent Seven” group drove much of the market’s action last year.

Nvidia skyrocketed 171%, while Apple saw a 30% gain.

Investors will now be shifting their focus to key data releases, including US jobless claims, due Thursday.

Over the coming months, the market will closely monitor global economic growth, particularly in Europe and China, as well as the Federal Reserve’s interest rate policies and President-elect Trump’s agenda for his second term.

European stocks open mixed

European stocks showed a mixed performance on Thursday as traders returned to their desks after the New Year holiday.

The pan-European STOXX 600 slipped 0.1% to 507.08, pulling back from a near two-week high after experiencing its sharpest quarterly decline in over two years from October to December.

The German DAX and the UK’s FTSE 100 showed little movement, while France’s CAC 40 fell by over 1%.

In economic news, UK house prices rose by 4.7% year-on-year in December, surpassing the 3.7% growth recorded in November and exceeding economists’ expectations of a 3.8% increase, according to data from Nationwide Building Society.

However, on a monthly basis, house price inflation slowed to 0.7% in December from 1.2% in November.

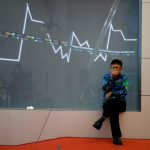

Asian stocks end first day of 2025 mostly in red

Asian stocks started the new year on a cautious note after a strong 2024 for global equity markets.

Japanese and New Zealand markets were also closed for a holiday.

The Caixin/S&P Global manufacturing PMI for China dropped to 50.5 in December, down from 51.5 in November, falling short of analysts’ expectations.

Disappointing Chinese factory activity data signalled a challenging economic outlook and increasing calls for additional policy support.

This contributed to a significant sell-off in Chinese markets, with the Shanghai Composite index falling 2.66% to 3,262.56.

Hong Kong’s Hang Seng index also slid 2.18% to 19,623.32, despite China’s promise of more proactive economic policies in 2025 to meet a growth target of around 5%.

In South Korea, stocks finished marginally lower, weighed down by factory activity data showing contraction in December.

Political uncertainty also added pressure, as impeached President Yoon Suk Yeol continued to resist arrest for a third consecutive day.

Australian markets closed higher as trading resumed after the New Year holiday.

The benchmark S&P/ASX 200 gained 0.52% to 8,201.20, while the broader All Ordinaries index settled 0.53% higher at 8,465.

Indian stocks also had an excellent day at the bourses.

Benchmark Sensex 1,436 points or 1.83% to 79,943.71. During the day, the 30-stock index also climbed over the 80,000 mark.

The post US stocks may end 4-day losing streak on Thursday as Nasdaq, S&P futures jump appeared first on Invezz